estate tax changes in 2025

The IRS released Revenue Procedure 2021-45 which announces the increase in 2022 of the estate gift and generation-skipping transfer tax applicable exclusion amounts from. 2020 Personal Income Tax Rates.

How Could We Reform The Estate Tax Tax Policy Center

21 hours agoBuffalo is planning to reassess all residential and business properties launching a reassessment project in January with a goal of reflecting the new property values in the July.

. It means that a millionaire or billionaire can give away this amount and a couple. What are Property Real Estate Taxes. Indexed annually for inflation the BEA is 1206 million per person in 2022 and will increase to 1292 million in 2023.

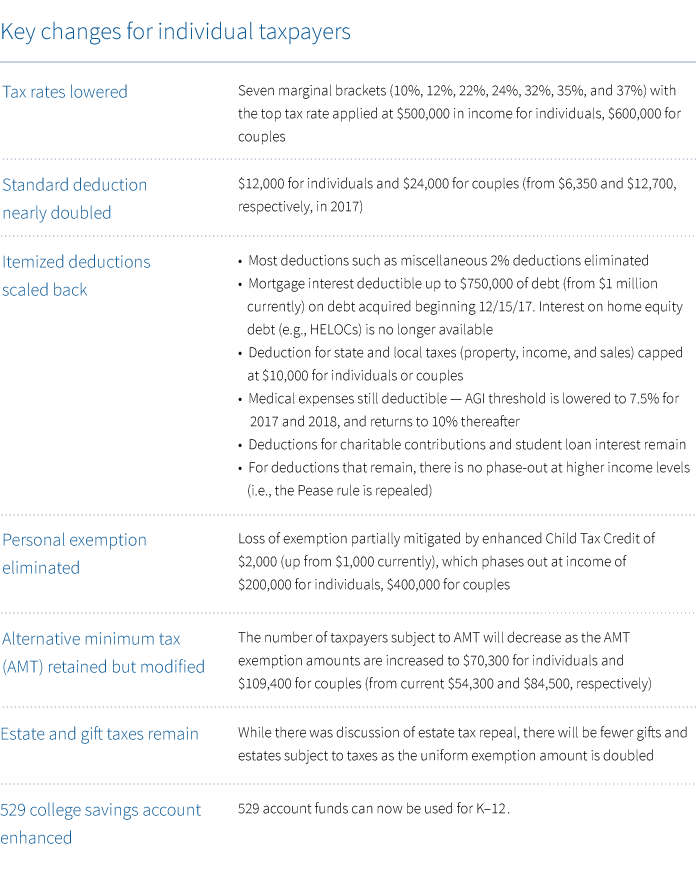

The major source of revenue for the 351 cities and towns in Massachusetts is the property tax. At these levels it is estimated that more than 95 of. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

In 2026 the current estate and gift tax exemption also known as the unified tax credit will be cut almost in halfand maybe more if Congress eventually succeeds in their. If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption amount. A STAMP Duty cut will end in 2025 the government has announced.

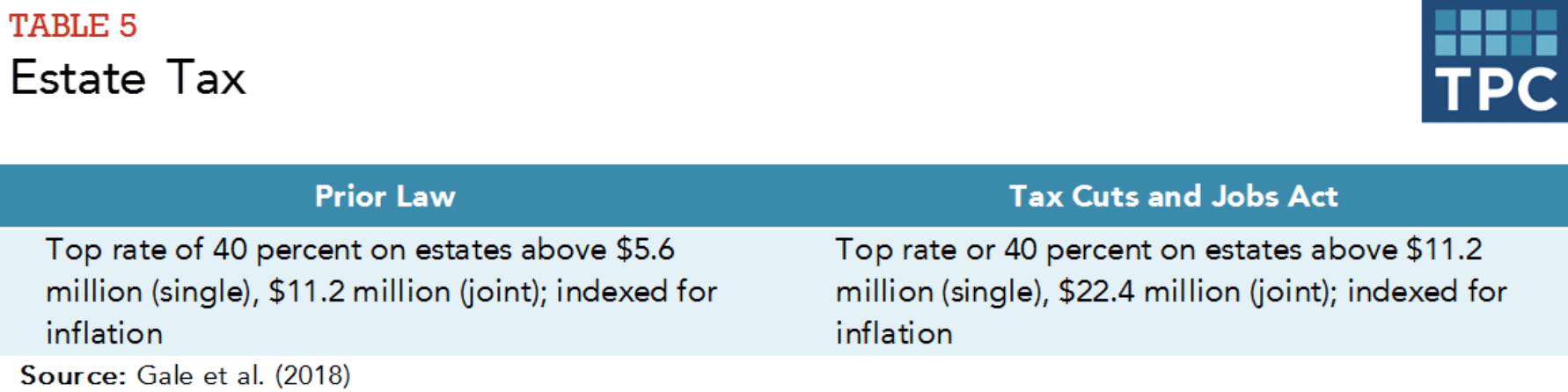

2025 Riverdale St UNIT 2025 West Springfield MA. The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted. This is the amount one person can pass gift and estate tax free.

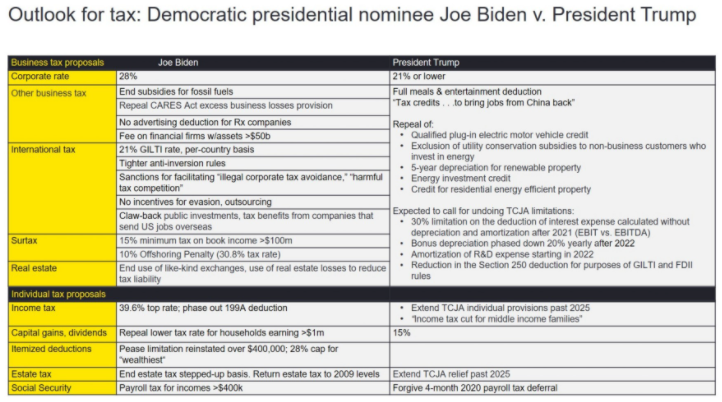

The tax reform law doubled the BEA for tax-years 2018 through 2025. Key tax changes. The TCJA temporarily increased the BEA from 5.

A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax. 1 day agoThe federal estate tax exemption has been raised from 12060000 to 12920000 for 2023. After that the exemption amount will drop back down to the prior laws 5 million cap.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million at the end of 2025 falls to roughly 65. Effective for tax years beginning on or after January 1 2020 the tax rate on most classes of taxable income is changed to 5.

Starting January 1 2026 the exemption will return to 549 million. The property tax is an ad valorem. Published October 14 2020.

Because the BEA is adjusted annually for inflation the. How did the tax reform law change gift and estate taxes. - Halving the Capital Gains Tax annual exemption from 12300 to 6000 in 202324 and again to 3000 in 2024-25 - a hit for landlords in particular.

It contains 0 bedroom and 0 bathroom. Chancellor Jeremy Hunt revealed the change to housing tax in his Autumn Statement today. These changes were instituted by the IRS pursuant to the federal law enacted in 2017However the estate tax law is set to expire in 2025If Congress does not extend the.

The estate tax exclusion has increased to 1206 million. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021 Congressional Research Service httpscrsreportscongressgov. The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax.

115-97 effective from 2018 to 2025. Estate Tax Exclusion Changes Now and in 2025. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Estate Tax Current Law 2026 Biden Tax Proposal

How Could We Reform The Estate Tax Tax Policy Center

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Preparing For The 2025 Tax Sunset Creative Planning

The Wealthy Now Have More Time To Avoid Estate Taxes

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Here Are More Key Wine Business Tax Changes For 2018

Senate And House Agree On Final Tax Bill Putnam Investments

The Estate Tax And Lifetime Gifting Charles Schwab

Farmers Ranchers Need Permanent Fix For Estate Tax Texas Farm Bureau

The Final Trump Gop Tax Plan National And 50 State Estimates For 2019 2027 Itep

How Many People Pay The Estate Tax Tax Policy Center

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Irs Bumps Up Estate Tax Exclusion To 12 92 Million For 2023

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Jimenez Associates Inc Estate Gift Tax

Revamping How We Think About And Analyze Gift Planning Options Ppt Download

:max_bytes(150000):strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)